The Fed is keeping interest rates unchanged. But two "dissidents" wanted a cut.

The US central bank kept the interest rate unchanged unchanged. Although the decision was not unanimous, it was in line with expectations. market. Such a "pause" in the cycle interest rate cuts have been ongoing since November.

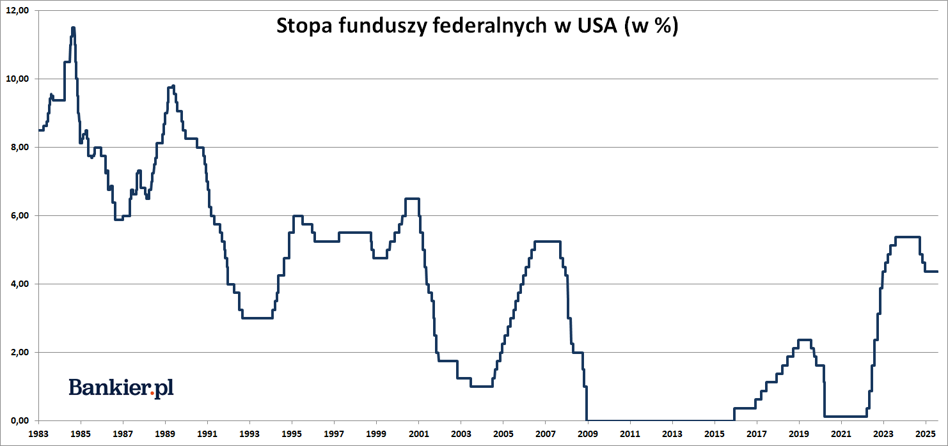

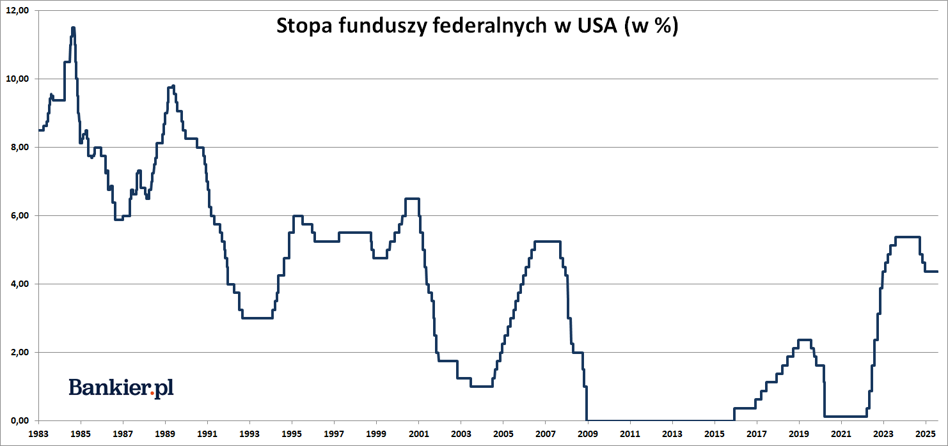

The federal funds rate range remained unchanged at 4.25-4.50% - the Federal Open Market Committee (FOMC) announced in a statement. July The decision was not unanimous. Two FOMC members voted in favor of the 25 basis point rate cut: Michelle Bowman and Christopher Waller. This was the first time since 1993 that two members of the seven-member Federal Reserve Board voted against the chairman and the committee majority. Typically, in cases of controversial decisions, only one "dissenter" emerged.

It's worth noting that both Michelle Bowman and Christopher Waller were appointed by President Donald Trump (as was Chairman Jerome Powell, who was nominated to the board by Barack Obama) and both are mentioned as potential successors to Powell. The Committee currently comprises seven Federal Reserve board members (nominated by US presidents) and five representatives from regional Fed branches.

Too in June the FOMC decided to leave interest rates unchanged and then also This did not surprise the financial markets. The break in the 2024 The interest rate cut cycle has been going on since December. The Reserve Bank's management The Federal Government does not decide to lower the cost of credit despite strong – and often not very civilized – pressure from President Donald Trump, who would prefer to see lower rates to reduce the cost of servicing the monstrous US public debt .

Advertisement- Jerome Powell is an idiot who has no clue about anything (…)He is still late, but it doesn't matter much because our country is strong – yes The White House host commented on the May FOMC decision . Recently, President Trump has softened his vocabulary a bit, but no longer calls for Jerome Powell to be fired.

- The Committee is sensitive to risks to both sides of its dual mandate – this phrase was copied from the June FOMC statement – Uncertainty about the economic outlook remains elevated – we read in the July statement Federal Open Market Committee.

A prolonged pause in the rate cut cycleIt's been over 8 months since the last rate cut interest rates at the United States Central Bank. Monetary cycle loosening began in September 2024, nervous and a substantively unjustified cut of 50 basis points at once . This move Chairman Powell explained rather vaguely as "recalibration" monetary policy . Further reductions in the federal funds rate – this total of 25 basis points each – took place in October and November. Total the scale of last year's cuts was therefore 100 basis points. But since the start of the second During Donald Trump's term as US President, the Fed no longer lowered rates.

- We believe that our current monetary policy stance allows us to respond appropriately in time to potential changes in the situation economic – explained the chairman during the June press conference Powell.

But in March the FOMC did not change the level of interest rates, but decided to limit the "quantitative tightening” (QT) of monetary policy. Starting from April, the Reserve The Federal Reserve has reduced the pace of reducing its balance sheet total from 60 billion to 40 billion. USD per month. This "quantitative tightening" restriction was a form of easing monetary policy in the US.

When will feet finally be cut again?Financial market participants have been postponing their time for the next cut in the federal funds rate. In January, cuts rates were expected in May. In May it was assumed that it would happen in July. Now we have July and market expectations point to September. The futures market is pricing in a 66% the chances of at least a 25 basis point reduction in the federal funds rate September FOMC meeting.

By the end of 2025, a total of 50 basis points of cuts are included in the price. year, the market is pricing in further cuts with a total scale of 50-75 bps. In this way, By the end of 2026, the federal funds rate would fall to around 3%. around levels considered neutral by most in the long term FOMC members.

- The Committee is strongly committed to supporting the mandate full employment and bring inflation back to the 2 percent target – recalled in the July statement of the Federal Open Market Committee.

Next Federal Open Market Committee Meeting is scheduled for September 16-17.

bankier.pl